Not known Facts About Medicare Advantage Plans

The smart Trick of Medicare Advantage Plans Faq That Nobody is Talking About

Table of ContentsThe smart Trick of Medicare Advantage Plans Faq That Nobody is Talking About5 Simple Techniques For What Is Medicare Advantage PlansEverything about What Is Medicare Advantage PlansExcitement About Medicare Advantage Plans Explained

The scores are given out annually by the Centers for Medicare & Medicaid Solutions, which ranks Medicare health insurance in 5 major categories: Preventative care Chronic treatment Prescription medicine services Customer care Participant complete satisfaction 2023 rankings our medical health insurance score high for high quality and also service Everybody at Kaiser Permanente is devoted to offering our participants with premium treatment and also a far better experience as well as it receives our consistently high star scores.Learn much more regarding Medicare.

The basic info in this brochure supplies a review of the Medicare program. Extra detailed details on Medicare's advantages, prices, and also wellness solution options is offered from the Centers for Medicare & Medicaid Services (CMS) publication which is mailed to Medicare beneficiary homes each fall and to new Medicare recipients when they come to be qualified for protection.

These consist of lab services, home wellness treatment services, outpatient medical facility services, blood substitute, and also preventative solutions, among others. (), as described in even more information under Choices for Receiving Wellness Treatment Services. (), as defined in even more detail under Prescription Drug Insurance Coverage. You may believe that Medicaid as well as Medicare are 2 various names for the same program.

The Single Strategy To Use For Medicare Advantage Plans Faq

Medicaid is a State-run program designed mostly to help those with reduced income as well as few sources. Each State has its own regulations concerning that is qualified and what is covered under Medicaid. Some people get approved for both Medicare and also Medicaid. For even more information regarding the Medicaid program, call your local medical help firm, social services, or welfare office.

To do this, SSA utilizes the most recent tax obligation return details offered by the IRS. In enhancement to the month-to-month costs you pay, there are various other out-of-pocket expenses for Medicare which may additionally transform each year.

If you are hospitalized, you will certainly be required to pay an insurance deductible quantity as well as you might have to pay coinsurance quantities, depending on exactly how long you stay. In 2023, the health center insurance deductible amount is $1,600. If you receive clinical solutions from a medical professional, you pay an annual deductible quantity along with a coinsurance quantity for each and every visit.

After meeting this quantity, Medicare typically pays 80 percent of covered services for the remainder of the year. If you can not manage to pay your Medicare costs click reference as well as other medical prices, States supply programs for low-income people who are qualified to Medicare. The State-run programs might pay some or all of Medicare's premiums and might additionally pay Medicare deductibles as well as coinsurance.

Top Guidelines Of What Is Medicare Advantage Plans

This is called your first registration duration. A delay on your part might create a hold-up in coverage and result in higher premiums. If you are qualified at browse around this site age 65, your preliminary enrollment duration starts 3 months prior to the month of your 65th birthday; consists of the you could try this out month you turn age 65; and also ends 3 months after the month of your 65th birthday celebration.

If you already have various other medical insurance when you end up being eligible for Medicare, you ought to ask whether it is worth the regular monthly premium expense to enroll in Medicare Part B protection. The answer differs with each person and the type of other health and wellness insurance coverage you might have. Although we can not offer you yes or no answers, we can provide a couple of pointers that might be useful when you make your decision.

Group health insurance plan for companies with 20 or even more workers are needed by legislation to use employees and also their partners that are age 65 or older the exact same health and wellness benefits that are given to younger workers. If you presently have insurance coverage under an employer-provided group health insurance plan, you should speak with your human sources office prior to you register for Medicare Part B.

The Best Guide To Medicare Advantage Plans Explained

Nevertheless, if you are an active-duty service member, or the spouse or reliant youngster of an active-duty solution participant, you may not need to obtain Medicare Part B right away. You can get Part B during a special enrollment period, as well as in most cases you won't pay a late enrollment charge (Medicare Advantage Plans).

A beneficiary can see any kind of doctor or carrier who accepts Medicare as well as is accepting new Medicare individuals. Those enrolled in the Original Medicare Plan that want prescription medicine protection need to sign up with a Medicare Prescription Medicine Plan as defined under Prescription Drug Protection, unless they currently have medicine insurance coverage from a current or previous company or union that goes to the very least just as good as the basic Medicare prescription medication coverage.

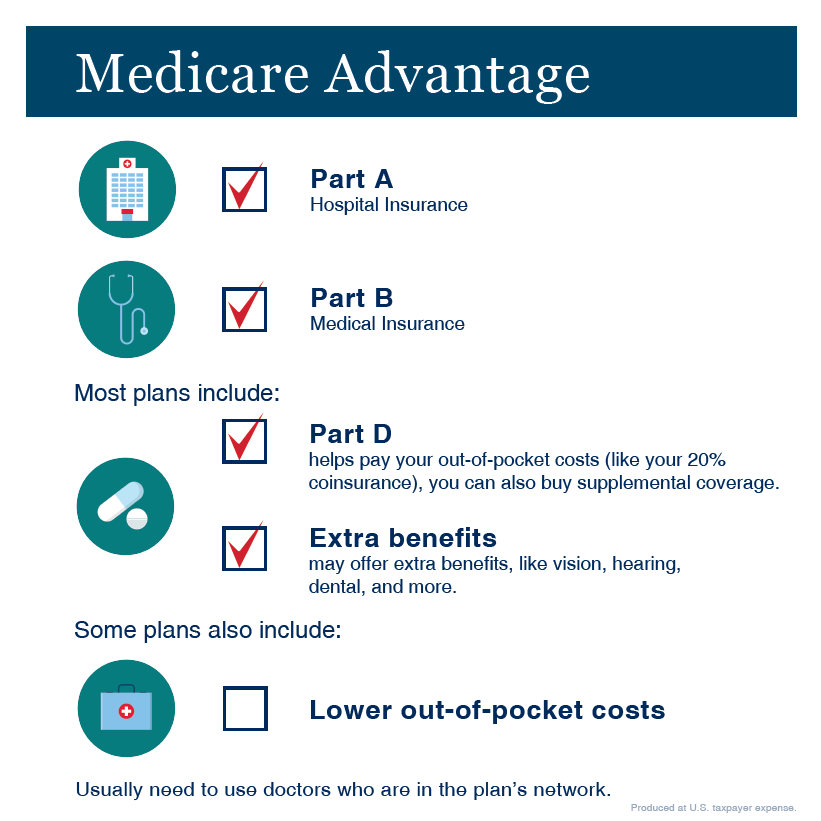

These strategies are taken care of by Medicare-approved exclusive insurance provider. They integrate Medicare Component An and also Component B coverage, and are available in many locations of the nation - Medicare Advantage Plans FAQ. A beneficiary must have both Medicare Part An and Part B, and also live in the plan's service location, to sign up with a Medicare Benefit Plan.